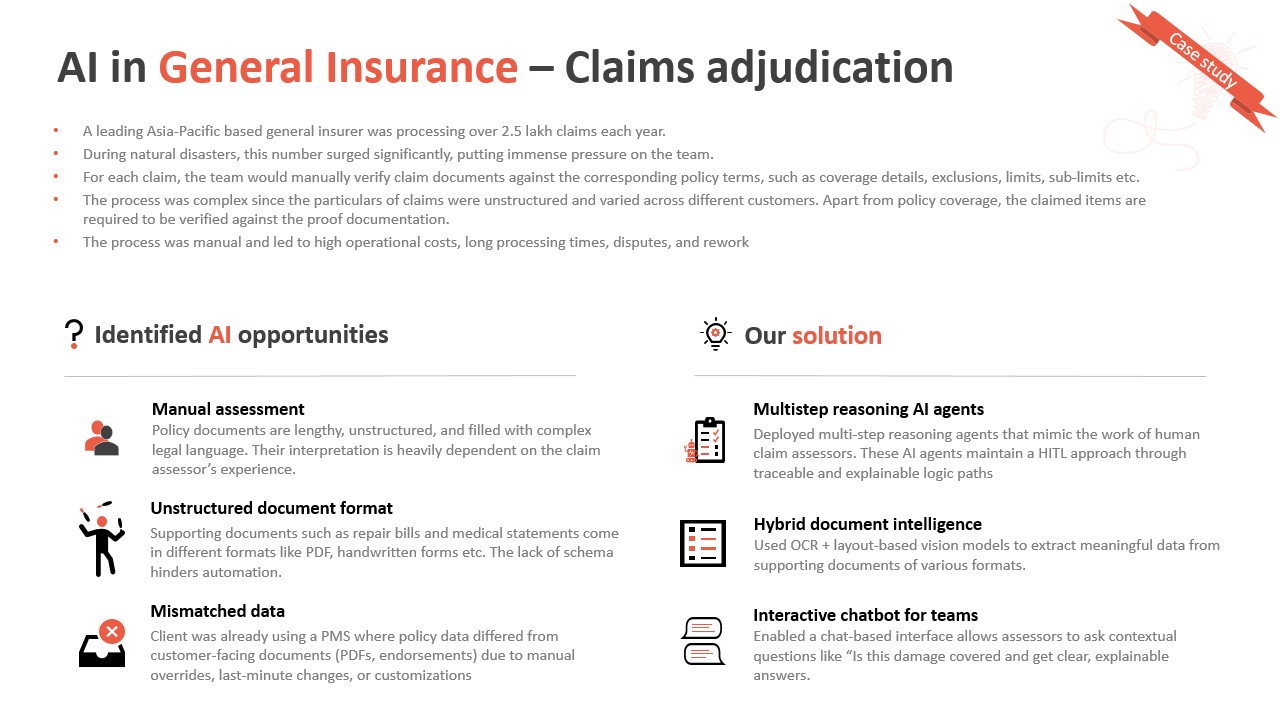

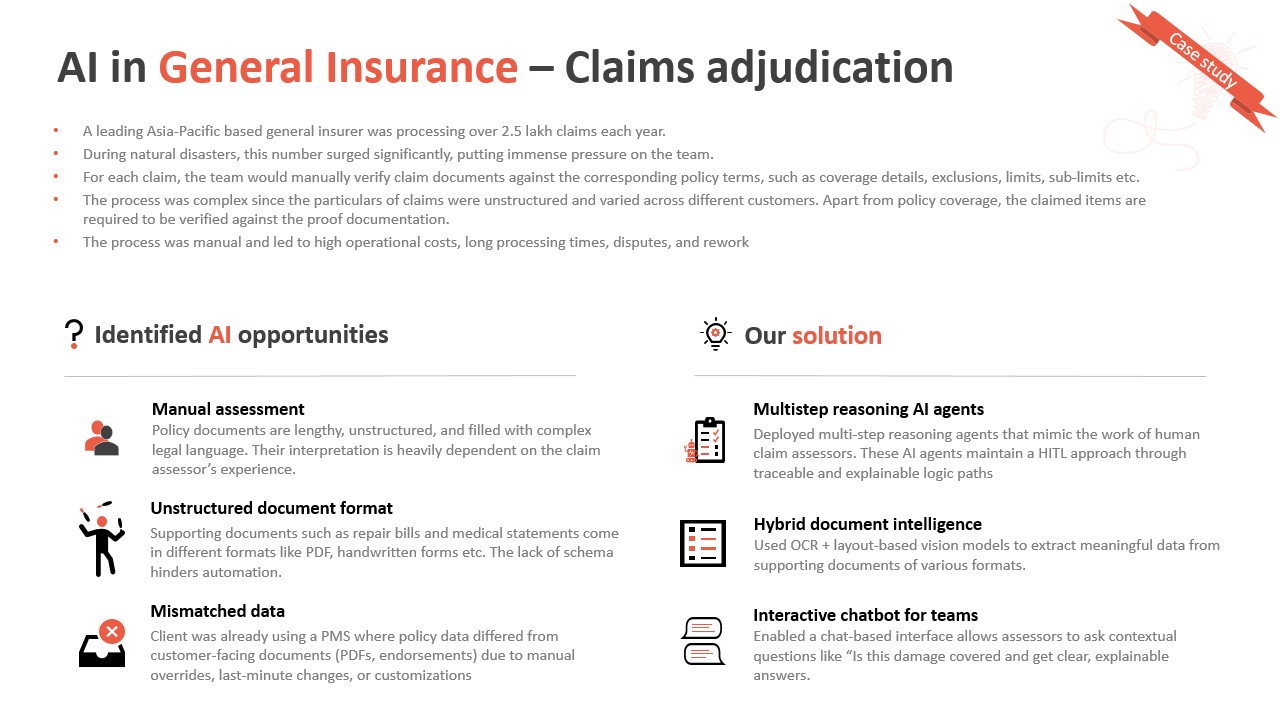

Insurance claims processing is a critical yet highly manual function for most insurers, particularly in the Asia-Pacific region where claim volumes can surge dramatically during natural disasters. One general insurance provider was processing over 2.5 lakh claims annually, with volumes skyrocketing during catastrophic events. Their claims team struggled with manual verification, unstructured documents, mismatched policy data, and long turnaround times.

We implemented an AI-powered claims adjudication solution. It mimicked human decision-making using multistep reasoning agents, extracted data from varied document formats using hybrid document intelligence, and empowered teams with a contextual chatbot interface.

It resulted in a dramatic improvement in operational efficiency, reduced error rates, and faster claims resolution without sacrificing compliance or accuracy.

Challenges in traditional claims processing

-

Manual assessment of policy coverage

Claims adjusters had to interpret lengthy policy documents filled with legal and domain-specific jargon. This process relied heavily on the experience of each assessor, often leading to inconsistent interpretations.

-

Unstructured document formats

Claims were supported by various documents- repair bills, medical reports, police statements, often submitted as scanned PDFs or even handwritten forms. The absence of a standardized schema made automation nearly impossible.

-

Mismatched data across systems

There were frequent discrepancies between policy data stored in the internal policy management system and customer-facing documents like endorsements and PDFs. These inconsistencies were due to manual edits, last-minute customizations, or overrides, leading to errors and time-consuming revalidation.

-

Surge-driven scalability issues

During floods, earthquakes, or storms, claims surged dramatically. The manual workflow couldn’t scale with demand, causing delays, customer dissatisfaction, and increased costs.

Our approach involved engineering a comprehensive AI-powered system that could handle scale, complexity, and compliance, all while integrating with their existing infrastructure.

Key features delivered

- Multistep reasoning AI agents: We built multi-step reasoning AI agents that could simulate the work of experienced claims assessors. These agents evaluated claim details, matched them against policy terms (coverage, exclusions, limits), and provided traceable, explainable decisions. Human reviewers could step in whenever needed, ensuring a human-in-the-loop setup for high-risk claims.

- Structured understanding of policy documents: Policy documents are complex and unstructured. Those were parsed using NLP models tailored to legal and insurance terminology. This enabled the automatic extraction and contextual linking of critical policy clauses, coverage definitions, and exclusions.

- Hybrid document intelligence: Supporting claim documents, such as medical bills, repair invoices, or images, came in a mix of structured, semi-structured, and unstructured formats. We used a hybrid stack combining OCR, layout-based vision models, and language models to extract relevant details, match them to policy rules, and identify inconsistencies.

-

Chat-based interface for the claims team: To improve usability and adoption, we introduced a conversational AI layer. Assessors could ask natural language questions such as “Is damage from flooding covered under this policy?” or “What’s the deductible limit for this claim?” and get precise, explainable responses backed by the AI agents’ reasoning.

- Seamless integration and scalability: The solution was built to plug into the client’s existing claim intake and processing systems with minimal disruption. Modular microservices architecture ensured scalability during peak periods (e.g., natural disasters), and allowed continuous learning from claim outcomes to improve the system over time.

Results achieved

- 40% faster claim resolution: By automating core verification steps and enabling intelligent routing, claims that previously took days were now processed within hours.

- Significant cost savings: Reduced dependency on manual labor and minimized rework caused by interpretation errors or data mismatches.

- Improved audit readiness: With traceable logic paths and explainable AI decisions, the system remained compliant with regulatory requirements while enhancing trust and transparency.

Conclusion

This AI solution demonstrated how AI can augment, not replace, human expertise in complex, regulated environments like insurance. By combining domain-specific NLP, reasoning agents, and intelligent automation, the insurer was able to modernize their claims process without disrupting existing operations.

The solution not only improved speed and accuracy but also enabled the organization to respond resiliently to crisis-driven surges, a critical capability in regions prone to natural disasters.

Want to explore how AI can transform your operations?

If you’re an insurance leader looking to leverage AI for your operations, please feel free to contact us or book a free AI consultation with our team.